Obtain actionable, independent ipo insights

The research process used by theipo experts at renaissance capital

IPO Intelligence is the leading independent pre-IPO research platform for institutional investors, financial sponsors, investment banks and IPO advisory firms. Our service provides real-time IPO alerts and in-depth fundamental research, valuation analysis and financial models on every US IPO and major global listings.

It is the premier resource for comprehensive tracking of the US and global IPO markets. The top institutional investors rely on IPO Intelligence to help identify and analyze these new investment opportunities.

Our research can be tailored to our clients’ areas of interest, including small vs large cap, growth vs value, U.S. vs International, sector focus, etc. Clients are able to consult with our research analysts and request custom data sets.

Contact Us to learn more about our IPO Intelligence Research platform.

Full IPO Lifecycle Research

Private Company Watchlist

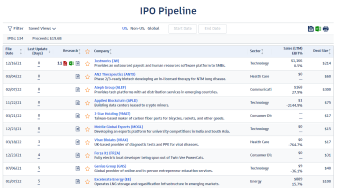

IPO Pipeline

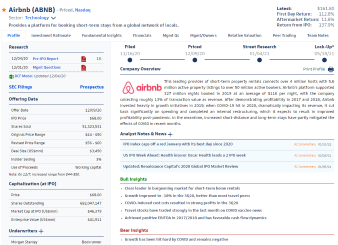

Profile

Mgmt Questions

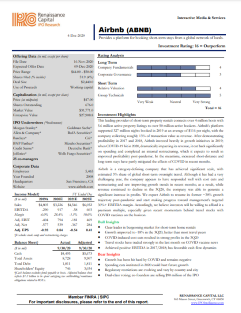

Pre-IPO Research

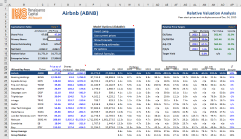

Comp Table / DCF Model

Pricing Insights

In-Depth Pre-IPO Research: Our Pre-IPO research gives you an actionable investment opinion on every IPO. Within days of an IPO filing terms, you’ll have an in-depth but highly scannable look at the business, management team and shareholder makeup, valuation and relevant comparables. You’ll get the real bull and the bear case for every deal, relevant industry insights and meeting prep questions for management meetings.

DCF Models and Comp Sheets: Our Excel DCF models allows users to scrutinize line-by-line our forward financial estimates, measure the effect of different growth forecasts on our fair value estimate, and integrate the data with their own investment platforms. It also integrates with our comp sheets, letting you see the impact of changes in estimates or multiples and allowing you to customize the peer group.

Improved Aerial View: Our detailed calendars provide a dashboard for all upcoming U.S. and non-U.S. new listings, as well as quiet period and insider lock-up expirations. Our clients also receive regular top down IPO market commentary, including weekly, monthly, quarterly and annual IPO reviews.

Comprehensive Coverage: We cover all industries, market capitalizations and institutionally investable foreign listings. Each prospective IPO flows through the multi-step coverage process shown above.